Calculate my salary after taxes

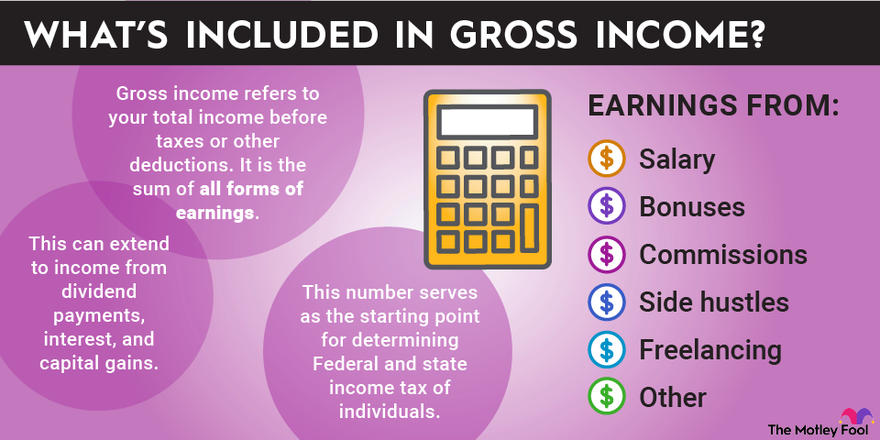

The calculator will work out how much tax youll owe based on your salary. Next from AGI we subtract.

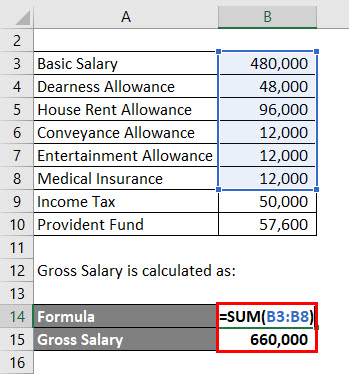

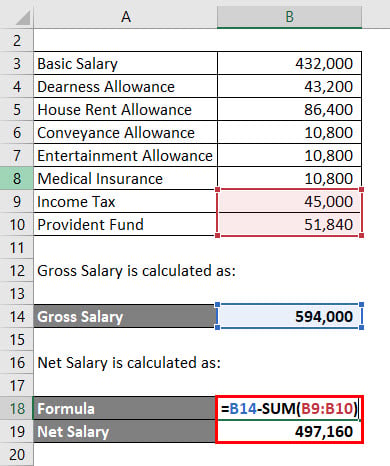

Salary Formula Calculate Salary Calculator Excel Template

However this is assuming that.

. Ad See the Paycheck Tools your competitors are already using - Start Now. Either way we hope to aid you in your investigations with this easy to use tax-on-salary calculator. Your average tax rate is 270 and your marginal tax rate is 353.

Ad See the Paycheck Tools your competitors are already using - Start Now. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. Youll then get a breakdown of your total tax liability and take-home.

These taxes together are called FICA taxes. With our New Zealand salary calculator you can quickly estimate your wages after taxes. If you are earning a bonus payment one month enter the value of the bonus into the.

GetApp has the Tools you need to stay ahead of the competition. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS.

How to Increase a Take Home Paycheck. This marginal tax rate means that your immediate additional income will be taxed at this rate. If you make 55000 a year living in the region of California USA you will be taxed 11676.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. To use the tax calculator enter your annual salary or the one you would like in the salary box above. Youll then see an estimate.

The easiest way to achieve a salary increase may be to simply ask for a raise promotion or bonus. All you have to do is select the frequency with which youre paid enter your gross salary and then. Simply enter your gross salary choose if youre being paid yearly monthly or weekly and let our site do the rest.

GetApp has the Tools you need to stay ahead of the competition. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Your average tax rate is 217 and your marginal tax rate is 360.

Find out how much your salary is after tax Enter your gross income Per Where do you work. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. For instance an increase of.

Gross pre-tax Income Per. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55000 Federal.

You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. This marginal tax rate means that your. Our German salary calculator or Gehaltsrechner automatically estimates your take-home salary after all taxes and contributions have been paid.

Your average tax rate is. Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

That means that your net pay will be 43041 per year or 3587 per month. To use it simply select which state you live in. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. That means that your net pay will be 43324 per year or 3610 per month. For example if an employee earns 1500 per week the individuals.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. Total annual income Tax liability. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Gross Pay And Net Pay What S The Difference Paycheckcity

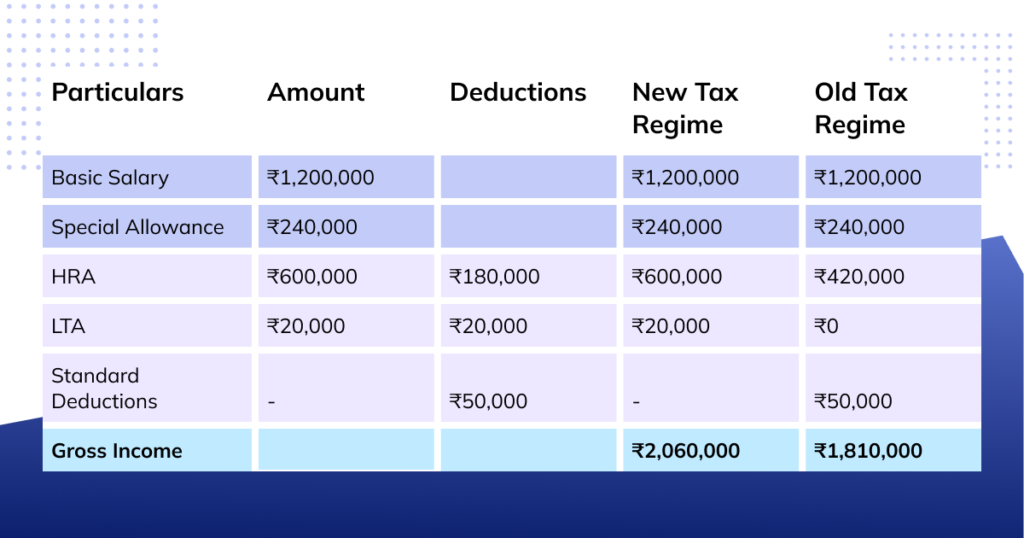

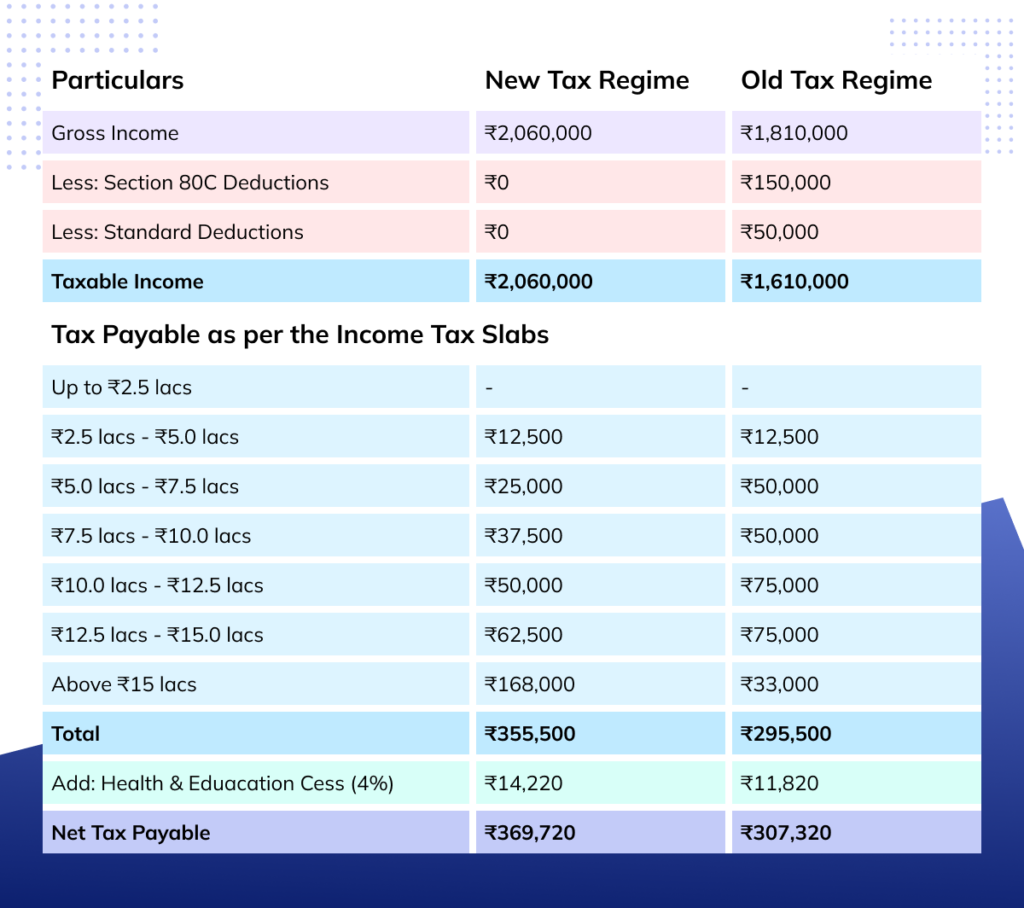

How To Calculate Income Tax On Salary With Example

Paycheck Calculator Take Home Pay Calculator

How To Calculate Net Pay Step By Step Example

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Ohio Paycheck Calculator Smartasset

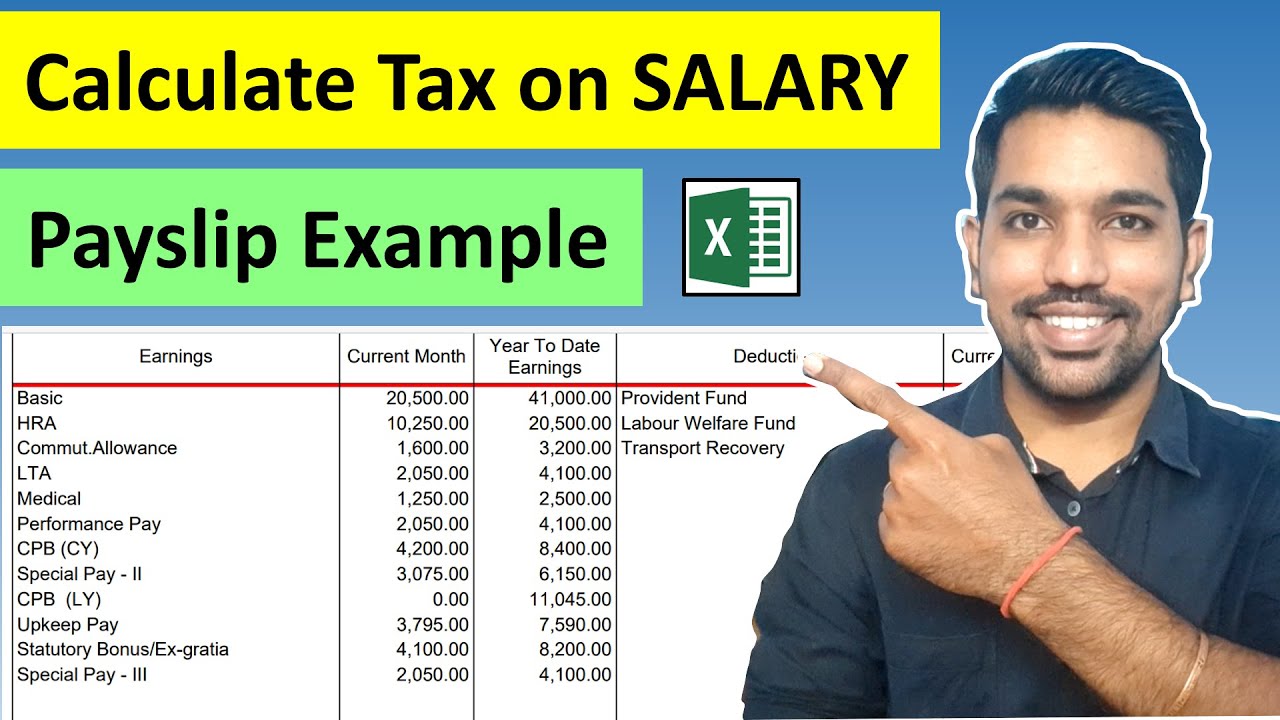

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Gross Income Per Month

How To Calculate Income Tax On Salary With Example

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

4 Ways To Calculate Annual Salary Wikihow

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Foreigner S Income Tax In China China Admissions